Financial Empowerment for Youth Who Age Out of Foster Care

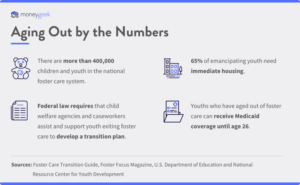

When youths get close to aging out of foster care, it’s important to plan for emancipation. Aging out of foster care — or emancipating — is the termination of court jurisdiction over youths formally in foster care.

U.S. federal law requires a transition plan to be established six months before a youth’s 18th birthday, but this is a crucial time to plan to ensure a youth’s success and financial future.

Age of Transition and Extended Foster Care by State

Youths may transition out of the child welfare system as early as age 18 or as late as age 22, depending on a state’s age out and extended foster care policy.

Transition planning can help youths, foster parents and child welfare agents to successfully adjust youths to adult life and responsibilities, with an understanding of their educational opportunities, housing options, health insurance and job-search support.

The consequences of failing to do so can be dire. Within 18 months of emancipation, 40 to 50% of youths who were in the foster care system become homeless, according to Foster Focus Magazine.

To help youths in the foster care system successfully transition into adulthood, MoneyGeek seek to identify the financial roadblocks they face and empower them with tools and resources they need to overcome those barriers.

5 Financial Roadblocks Youths Aging Out Face and How to Overcome Them

Understanding the financial roadblocks youths who have experienced foster care face is key to their financial empowerment. Lower levels of education, inconsistent financial role models, financial hardships, lower levels of income attainment and the lack of a safety net are hurdles the youths must overcome.

The risk of not addressing these financial barriers can lead to homelessness, which homelessness may be even starker for LGBTQ youths. Homeless, unaccompanied youths, who represent 6% of the homeless population, are a vulnerable age group consisting of those younger than 25 years old, according to the National Alliance to End Homelessness’s “State of Homelessness: 2022 Edition” report.

1. Inability to Attend or Afford Higher Education

For youths aging out of foster care, the struggles of living with day-to-day adult responsibilities can prove to be a difficult barrier to obtaining a college degree. Many employers may require additional education, such as bachelor’s and associate degrees and vocational or trade certificates. Higher levels of education or trade school can help you find a job or a higher-paying career.

According to the U.S. Department of Education, children in foster care are at a higher risk of dropping out of school and are unlikely to attend or graduate from higher education. A coordinated effort by education and child welfare agencies is necessary to improve the educational outcomes for students in foster care.

“Earning a college degree is an important step toward the middle class. Additionally, higher levels of educational attainment are associated with increased earnings and lower rates of unemployment,” according to the “Foster Care Transition Guide.”

The biggest barrier to continuing education for males and females is the inability to pay for education (59%), followed by the need to work full time (43%), according to a 2011 study, “Midwest Evaluation of the Adult Functioning of Former Foster Youth: Outcomes at Age 26.

BEST SOLUTIONS FOR ATTENDING AND AFFORDING HIGHER EDUCATION

There are financial aid resources available for youths who are experiencing or have experienced foster care. The first step to securing financial aid is to fill out the Free Application for Financial Student Aid (FAFSA).

Research colleges and figure out how much tuition and fees will cost compared with financial aid offers. Don’t forget to factor in college scholarships and grants.

Figure out what and where you want to study first, and then follow it with an execution plan. Take a look at this U.S. Department of Education College Preparation Checklist, which outlines the steps for how to get there.

The Education Training Voucher (ETV) program provides funding and support for post-secondary education. Eligible students may receive grants up to $5,000 per year for up to five years or until their 23rd birthday.

If you have a low income or are homeless, you can still attend and afford higher education. You might qualify for the College Cost Reduction and Access Act for unaccompanied homeless youths (UHY). It allows you to sign your FAFSA without a parent and calculate your financial aid based on your income, not an income of a parent or guardian.

Research additional financial aids and resources available for low-income and homeless students to help you navigate education expenses.

2. Inconsistent Financial Role Models

For most youths transitioning out of the foster care system, they lack strong financial role models. Many young adults learn to be financially secure from their parents, other family members, peers and other trusted adults.

Without financial guidance, youths leaving the foster care system tend to have difficulty understanding and developing strong money management skills, such as budgeting and learning to save. In addition, they may not understand the potential risks of identity theft when it comes to finances.

“Some learn that, as a result of identity theft, they have poor credit histories before they reach the age of majority, and often don’t have the social capital necessary to assist them in resolving problems, placing them at a higher risk for poor, long-term outcomes,” according to “A Financial Empowerment Toolkit for Youth and Young Adults in Foster Care.

BEST SOLUTIONS FOR FINDING FINANCIAL ROLE MODELS

Oftentimes, child welfare systems teach youths about financial capability and money management. Child welfare organizations and community support groups may have adults who can teach financial skills to youths aging out of the foster care system. Ask support group peers and trusted adults financial questions such as budgeting, saving, investing and banking options.

Before youths transition into adulthood, caregivers and child welfare workers should involve them in financial decision-making when appropriate and create exercises to engage in financial management skill development. Teach them how to visit businesses, government offices and banks to solve problems. Even explaining why certain purchase decisions are made can be effective educational tools.

You can also find a wide range of influential financial bloggers and podcasters who offer money management tips and skills online. Some of these experts are millennial bloggers and influencers who help demographics understand money in their culture and language. For example, there are several Latina financial influencers who help Latinos and Hispanics develop strong money habits and create wealth.

3. Greater Economic Hardships

Financial capability is important for all youths transitioning to adulthood, but it is crucial for youths transitioning out of foster care who have already faced other challenges and are expected to immediately manage their finances. Youths who have experienced foster care typically have greater economic hardships, such as not having enough money to pay rent and/or utility bills, having utilities shut off and being evicted.

In the study “Midwest Evaluation of the Adult Functioning of Former Foster Youth: Outcomes at Age 26,” 45% of participants reported experiencing at least one of five material hardships during the past year compared with 18% of their peers.

BEST SOLUTIONS TO MANAGE ECONOMIC HARDSHIPS

Learning how to be financially capable is the first step to financial literacy, which can protect against economic hardships.

There are five principal components: Earn, Spend, Save and Invest, Borrow and Protect.

- Earn: Understand your paycheck, deductions and taxes and invest in education.

- Spend: Understand how bank accounts work, track spending, set financial goals, set and live within a budget and live within your means.

- Save and Invest: Start saving and investing early, compare various investment opportunities, build an emergency savings account with three to six months of expenses and save for retirement. Learn about compound interest, how it works and use a compound interest calculator to help you in your investing journey.

- Borrow: Understand interest rates and shop around for the best rates when making large purchases, and know your credit score and how a credit report works.

- Protect: Purchase insurance policies, build an emergency fund, protect your identity and avoid scams and consult with a financial planner.Consider learning how credit cards work to build your credit and how to live on a low income so you can start saving. In addition, build relationships with trusted adults who can help you weather financial emergencies.

4. Higher Levels of Unemployment and Lower Annual Earnings

For adults who experienced foster care, they may experience high levels of unemployment and lower annual earnings.

In the study, “Midwest Evaluation of the Adult Functioning of Former Foster Youth: Outcomes at Age 26,” it followed youths in foster care for about eight years, beginning when the youths were 17 or 18 years old in three states (Illinois, Iowa and Wisconsin). They had to have been in the foster care system before they were 16 years old. Over the years, the total number of participants decreased from 732 to 596.

When the participants were re-interviewed at age 25 to 27, nearly 80% believed they needed additional education to achieve their career goals.

Only 9% of the young adults were participating in a job training program. And only 46% of study participants were currently employed compared with 80% of the control group, which is a nationwide representative sample of 25- to 26-year-olds.

On average, participants who were looking for a job had been searching for 5.3 months, and more than 20% had been searching for a year or longer.

Study participants also reported they earned significantly less than those in the control group. According to the study, the “difference in median annual earnings between the groups was more than $18,000.”

BEST SOLUTIONS TO MANAGE EMPLOYMENT CHALLENGES

Consider understanding and reviewing credit reports every 12 months to improve employment outcomes and ensure that they’re accurate, which will assist in passing pre-employment credit checks used to screen job candidates.

Try to develop a personal brand and execute it across your resume and LinkedIn profile. Build a network of professionals on LinkedIn by connecting with other people in your industry and make sure your resume shows where you’re going, and not just where you’ve been. Take a look online to see the average pay for the position you are applying for, and consider negotiating your first salary.

If you currently have a job, consider asking for a raise or negotiating for a higher income. You do not have to wait for your work anniversary, but keep in mind your company’s growth and direction when you ask. If your company doesn’t look like it is doing well, it may not be the right time to ask.

5. No Safety Net From a Biological Family

For most families, youths and young adults have a parent, extended family member or a sibling to reach out to when they need help. A strong safety net can help young adults get back on their feet when they are in trouble or hurt — whether physically, mentally or financially. It can also allow young adults to learn from their mistakes and navigate their adult life with ease.

The most significant challenge facing youths who have experienced foster care is a lack of a support network, particularly in the form of biological family members who can transfer knowledge, help with preparations and serve as a financial safety net in case of emergencies. There isn’t an extended family to turn to in times of crisis, such as a medical emergency or job loss, to avoid homelessness.

“Transitioning to adulthood is difficult for all young people,” the Foster Care Transition Toolkit states. “We know that foster youth may face even tougher challenges when they, seemingly overnight, are required to independently make decisions. It’s a lot to take on, but there are support systems and resources to help you succeed.”

BEST SOLUTIONS TO MANAGE OPERATING WITHOUT A SAFETY NET

The most important thing for youths in transition is to have a good support network through friends, caregivers, social workers, trusted adults, foster parents and mentors. Some foster families can be supportive and can provide a safety net. But this may not be the case for some youths.

If you need help finding a mentor, check out groups like Foster Youth in Action and iFoster, which work to match advocates and support groups with youths.

You can also create an emergency fund with three to six months of estimated expenses while still living in the foster care system. Before you leave care, consider looking into transition, independent living and extended foster care programs. Your state may have options to help you.

Child Welfare Information Gateway has a list of transition and independent living programs available to youths aging out. The National Conference of State Legislatures’s (NCSL) “Older Youth in Foster Care“ lists state information to help you find what is available in your state.

For each state, NCSL features information on these eight policies: driver’s license and auto insurance, diligent search requirements to identify relatives, extending foster care beyond age 18, health oversight, increasing placement stability, normalcy in foster care and tuition waivers for youth in foster care.

Expert Advice on Education and Finances

1. What are the challenges facing youth transitioning out of foster care?

2. What does aging out of foster care mean?

3. What percent of foster kids end up homeless?

4. How can people help youth aging out of foster care?

5. What kinds of financial barriers do youths face when emancipating?

6. What immediate financial steps should youths take when they are emancipating?

7. What sort of timeline is appropriate for youths once they age out of foster care? What’s the first step?

8. Are there mental and behavioral health resources to support youths during this transitional period?

9. Are there certain scholarships and/or grants that youths transitioning out of foster care qualify for?

10. What kind of resources are available to help emancipating youths with career transitions and job applications?

11. What are some ways foster parents can teach youths about finances and financial planning before they emancipate?

Resources for Youths Who Transition Out of Foster Care

There are many resources available to help youths who have experienced foster care and are emancipating as they transition into adulthood. Take a look below.

Financial Services and Programs

- BankOn: BankOn helps low-income individuals open low-cost starter bank accounts and access financial education. You can locate a program near you.

- Volunteer Income Tax Assistance (VITA): The IRS’s Volunteer Income Tax Assistance (VITA) program offers basic tax return preparation for individuals who make $56,000 or less. The company also provides this service to individuals with disabilities and people with limited English.

Tuition Assistance, Scholarships and Grants

- Education and Training Voucher (ETV): The Educational and Training Vouchers (ETV) Program helps students receive up to $5,000 per year for education.

- National Foster Parent Association Scholarship: The National Foster Parent Association offers $500 scholarships to those wishing to further their education beyond high school.

- Tuition Waiver Availability for Foster Care Youth: States whose legislatures grant tuition waivers to youths who have aged out of foster care include Florida, Texas, Minnesota, Maryland, Virginia, West Virginia and Maine.

- CareerOneStop Scholarship Finder: This site is sponsored by the U.S. Department of Labor. You can find various criteria for each financial aid in this national database that is offered to all levels of college students.

- Foster Care to Success: This organization works with foundations and individuals to give youths who are in foster care scholarship opportunities across the country.

Technical Tools, Games and Apps

- Practical Money Skills: Practical Money Skills offer fun games to teach you about money management. Test your money skills with games such as the Cash Puzzler, Peter Pig’s Money Counter and Financial Football 3.0.

- SmartyPig: You can make sure you’re on track with your financial goals, such as saving up for a home, a new car or a new gaming console. SmartyPig is a free online piggy bank to help you save money. You can have multiple goals and open a savings account for each goal.

- Auto Loan Calculator: If you are looking to purchase a car and need a loan, this MoneyGeek auto loan calculator will help you estimate your monthly loan payments. You can plug in the car price, annual interest rate, down payment, length of term in months, trade-in value and first payment date.

Job Search Support

- My Skills, My Future: You can input a past job title to find alternate career matches. This tool can help you focus on the career you want and determine what the job entails, such as typical job duties, hourly wages or annual salaries, work experience and the education level needed for the position.

- CareerOneStop’s Resume Guide: This resume guide includes tips for writing, formatting and a step-by-step plan for what to include in your resume.

Community Support and Advocacy Organizations

- FosterClub Permanency Pact: This free tool supports permanency for youths in foster care and encourages an adult to support a young person in foster care.

- Foster Care Alumni of America: This organization’s vision is to connect and empower people in and from the foster care system. It provides a sense of community and helps to reduce isolation for those who are transitioning out of foster care. You can find 24 state chapters nationwide.

- Foster Coalition: The Foster Coalition provides a wide range of resources for youths in foster care, foster parents and individuals interested in supporting the foster care community. You can find resources such as crisis hotlines, health care information, and free psychotherapy or healing organizations.

- FosterClub: This group’s mission is to lead young people who experienced foster care to become connected, educated, inspired and represented. There are opportunities for you to get involved as a young leader to support other individuals within the foster care system, such as training, events and conferences, local meet-ups and educating policymakers and stakeholders to improve the child welfare system.

- Together We Rise: This is a non-profit organization that helps children in foster care as they’re experiencing the system. It works with foster care agencies, social workers, advocates and volunteers to provide a sense of belonging and ways to improve children’s lives. Together We Rise’s projects and programs consist of birthday and superhero gift boxes, building bikes and skateboards and creating Sweet Cases (a duffle bag filled with hygiene products, a teddy bear and blanket).

Transition Resources

Independent Living and Housing Assistance

Svvy® 2024 The views and opinions expressed are those of the authors. They are meant for general informational purposes only and should not be construed or interpreted as a recommendation or solicitation. Svvy® does not provide investment, tax, legal, financial planning, estate planning, or any other personal finance advice. Svvy® holds no liability for the accuracy or timeliness of the information provided.